Is 'Maybe' Coming?

ISSUE #723: Aug. 12-18, 2018

2018-08-21

Brian Timmons Dear friends, When I started Residencias Los Jardines, I started writing a weekly newsletter -determined to tell all the good, bad, and the ugly. I knew some readers would be interested in the construction process. I expected others might be interested in the lifestyle of two people who had decided to live outside the box. For others, the adventures of Lita, the parrot and the cat took on an entertainment saga all its own. Residencias Los Jardines is finished. We periodically have re-sales and rental availability. Some readers may be interested in this information. Brian Timmons |

|

Featured

rentals & sales Paradisus Condos / Rohrmoser

Each of the units consists of two bedrooms / two bathrooms, and a large living/dining/kitchen area. The floor plan of each of these units has eliminated the optional "den / office" divider. The result is a larger area offering more flexible furniture arrangements while still maintaining the option of including an office area. At 105m2 plus two parking spots each and storage locker, they offer a great opportunity for someone seeking views, security, central location, and first class, all round living... PRICE REDUCTION Distrito Cuatro / Guachipelín / Escazú DOWNLOAD PDF    .jpg)    .jpg) .jpg) Real de Santa María / Borreal de Heredia

Download more pictures (8.35 Mb) Hyundai Santa Fe 2008 Hyundai Santa Fe 2008, Turbo Diesel, automatic, excellent family vehicle, safe, comfortable, interior with leather seats. Good tires, engine, turbo, suspension, and AC. Marchamo 2018 and Retive. It now has been road tested for 5 weeks and performed flawlessly. I can now sell with confidence...

|

|

Market activity

sales & rentals Sales: Los Jardines: Units #114 and #124 Rentals: Paradisus: Nothing available Los Jardines: Nothing available |

|

Residencias Los Jardines

property management, rentals & re-sales For sale

UNIT #114 Total Area (Sq Ft): 1290 This 2 bedroom/2bathroom,1,290 sf single floor end unit home includes a 150 sf front terrace plus parking for one car. This house is fully air conditioned and has recently been professionally decorated by international decorator Alcides Graffe and has undergone a complete renovation—new modern furniture, finishings, window coverings, and art work by Carlos Gambino. It is arguably the nicest furnished unit at Residencias Los Jardines and only steps from the pool UNIT #124 Total Area (Sq Ft): 662 This 662 sf, + covered parking for one car, is a one bedroom home on the 2nd floor overlooking the large pool. It is ideal for a single person or couple. |

|

Our Lives

Weather: Normal rainy season weather... wonderful... What Happened This Week:Is "Maybe" Coming?: Last week I said I had accepted an offer on D4 and the buyer was in the process of cashing out a CD. The deal was suppose to close Thursday... It is now Saturday and I keep hearing that yes, it will close, just a little glich at the bank????? yeah right... We'll see. In the meantime, I continue showing... who knows... Friends visited who have been trying to sell their small hotel. After several years, and numerous price reductions, they got an offer they accepted... At closing, the N. Am. purchaser couldn't come up with the financing... they had to scramble and put together a very different deal than the one they had accepted. They are hoping all will work out... Conclusion: Perhaps it is not just Ticos who cannot figure out financing and not only ticos who go shopping with no money in their pockets... Motor Cycles -Pathway to a fast death: On the way Tuesday to show D4, the traffic on the highway was very heavy / slow. It took 55 min. to travel what normally takes 10... I found the problem... A truck loaded with a dumpster which was full of metal and ?? debris had had a steel door fall out the back and onto a motor cycle. The bike was pretty well crushed... the driver and been removed... what looked to be a passenger was sitting off to the side of the road... An hour later I saw a bike crushed under an SUV. The driver of the bike was fine... but his bike needed substantial work. Heredia House: Looking good / looking lonely -no calls. Scotiabank: It seems they have a special capital drive underway... it also seems to be not well known amongst their employees / branches. A friend was notified and he passed along to me info on some special high interest rates with no locked in CDs. This is only for "new" money and short term... depending on the amount of "new" money deposited, rates of 14.25% on US dollars and 42% on colones. These rates are only committed until the end of December... so what is happening? don't know beyond speculation... the bank is now able to liquidate employees acquired via the purchase of Citi Bank... perhaps the liquidations and coming aginaldos for all employees has put the bank in a short term liquidity bind and this is the quick / easy fix out of it. Don't know... still exploring it... but when and if D4 sells, maybe I will play...even though I hate the bank... |

|

News Items of the Week

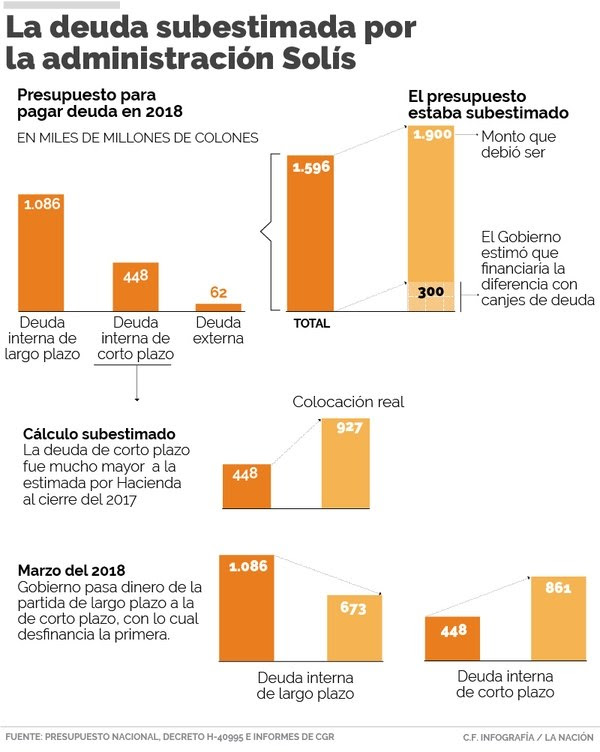

Comments: CR is in worse financial shape than previously admitted. In addition, before any tax reform can / will occur, there are over 1,000 amendment / revisions to work through in the legislature before anything can be implemented...

|

|

FOR RENTAL OR SALES INFORMATION Brian C. Timmons Costa Rica: Canada: Web: https://www.residenciaslosjardines.com |

Previous reports

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

2014

2013

2012

2011

2010

2009

2008

2007